CISN and many American’s now believe that access to health care, including quality cancer care, should be made available to everyone. With almost 50 million Americans without health insurance, and studies linking a lack of health insurance in America with increased death rates in cancer patients, health care reform is an urgent priority.

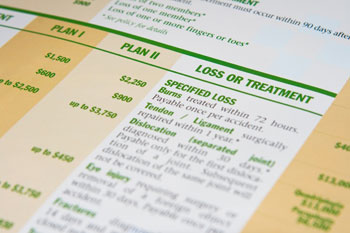

And even for those Americans with health insurance, coverage can be limited and expensive with high monthly premiums, deductibles, and other costs.

A study reported in the March/April 2006 Health Affairs shows about half of all filed personal bankruptcies in the United States cited medical causes as the reason. This study also found that 75.7 percent of those that filed bankruptcy had health insurance at the onset of illness.

Health Insurance and You

As you probably already know from your own experiences, cancer treatments, tests, doctors’ appointments, and follow up care are often a financial burden for patients and their families.

It is extremely important for patients to have health insurance that will offer the best medical coverage possible.